The U.S. Supreme Court recently issued a decision that could have a major impact on the lives of millions of Americans struggling with student loan debt. The court’s ruling will make it much easier for borrowers to discharge their student loans in bankruptcy.

This is good news for borrowers who are struggling to repay their loans. It will give them a fresh start and the opportunity to rebuild their finances.

But there are also some potential drawbacks to the ruling. For example, it could make it harder for borrowers to qualify for new loans in the future. And it could encourage more people to take on student loan debt, knowing that they can discharge it in bankruptcy if they can’t repay it.

Find most popular financial education, credit union, debt guide and many more with C1styourvoiceblog. Get tips and information for business growth, executive careers, personal life and performance. You will get on with making a better life for yourself.

Here’s a closer look at the pros and cons of the Supreme Court’s student loan debt relief decision:

The Pros

It will help borrowers who are struggling to repay their loans.

The Supreme Court’s decision will make it much easier for borrowers to discharge their student loans in bankruptcy. This is good news for borrowers who are struggling to repay their loans. It will give them a fresh start and the opportunity to rebuild their finances.

It could help to prevent defaults.

The ruling could also help to prevent defaults. If borrowers know that they can discharge their loans in bankruptcy, they may be more likely to make their payments on time and avoid default.

It could reduce the amount of student loan debt outstanding.

If more borrowers are able to discharge their loans in bankruptcy, it could reduce the amount of student loan debt outstanding. This would be a good thing for the economy as a whole, as it would reduce the amount of debt that needs to be repaid.

It could make it easier for borrowers to qualify for new loans.

The ruling could also make it easier for borrowers to qualify for new loans. If borrowers can discharge their old loans in bankruptcy, they will have a clean slate and may be able to qualify for new loans more easily.

The Cons

It could make it harder for borrowers to qualify for new loans.

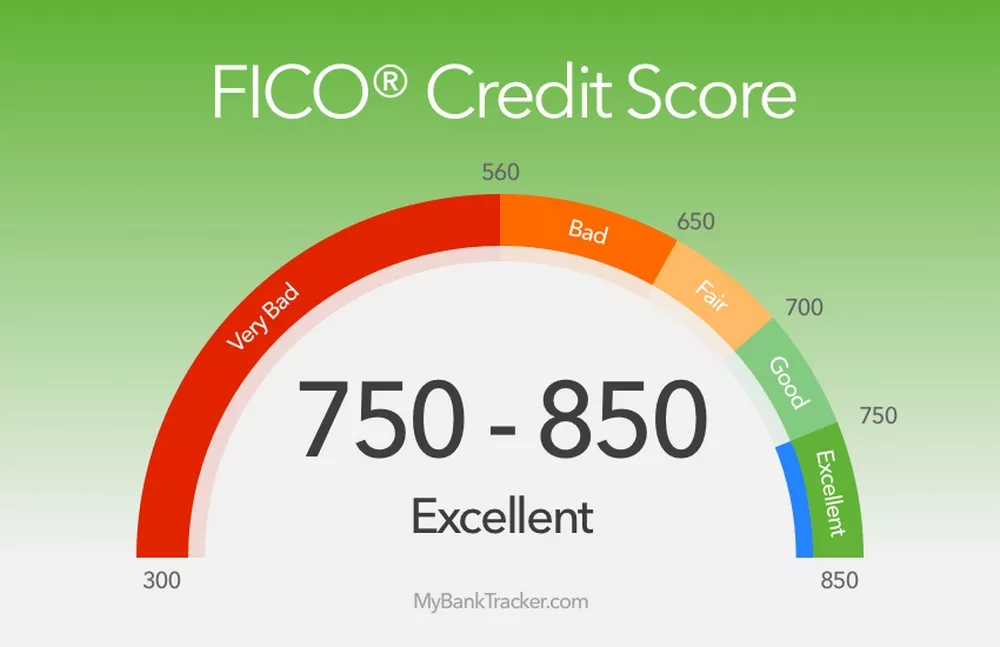

While the ruling could make it easier for borrowers to qualify for new loans, it could also make it harder for borrowers to qualify for new loans. If borrowers can discharge their old loans in bankruptcy, they will have a clean slate. But that also means that they will have no history of loan repayment, which could make it harder for them to qualify for new loans.

It could encourage more people to take on student loan debt.

The ruling could also encourage more people to take on student loan debt. If borrowers know that they can discharge their loans in bankruptcy, they may be more likely to take on debt that they cannot afford to repay. This could lead to more defaults and more debt for the economy as a whole.

It could make it harder for the government to collect on student loan debt.

If more borrowers are able to discharge their student loans in bankruptcy, it could make it harder for the government to collect on student loan debt. The government could end up losing money on loans that it guaranteed.

It could have a negative impact on the economy.

The ruling could also have a negative impact on the economy. If more borrowers are able to discharge their student loans in bankruptcy, it could reduce the amount of money that is available to lend to students. This could make it harder for students to finance their education and could lead to a decline in the quality of education.

The Bottom Line

The Supreme Court’s ruling on student loan debt relief is a mixed bag. There are some potential benefits, but there are also some potential drawbacks. Borrowers should carefully consider the pros and cons before deciding whether or not to take on student loan debt.