One of the most common mistakes people make when it comes to their liabilities is not having a clear understanding of what they are. A liability is anything that could potentially cause financial harm to you or your business. This could include things like credit card debt, outstanding loans, or even something as simple as a parking ticket.

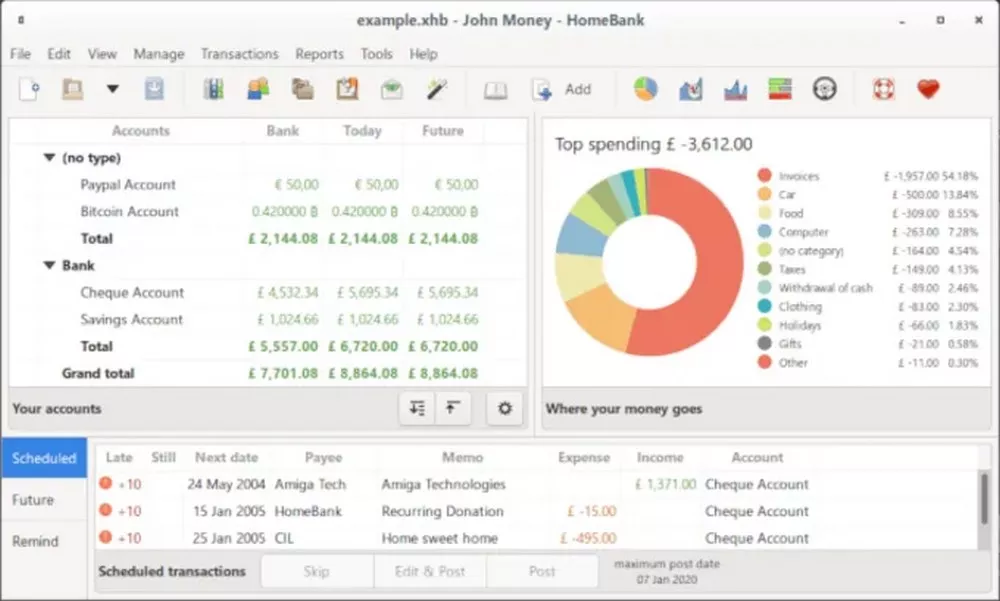

Another common mistake is not keeping track of their liabilities. This can be a big problem if you have multiple sources of debt, as it can be easy to forget about one or more of them. This can lead to missed payments and late fees, which can further damage your finances.

Finally, another mistake people make is not budgeting for their liabilities. This can cause serious financial problems down the road, as you may find yourself unable to make payments on time. Always make sure to budget for your liabilities, so you can avoid these common mistakes.

Assuming that their home is their only asset: A lot of people think that their home is their only asset, but this is not the case. Other assets can include savings accounts, investments, and even life insurance policies.

Not understanding the types of liabilities: There are two types of liabilities: secured and unsecured. A secured liability is one that is backed by an asset, such as a mortgage. An unsecured liability is one that is not backed by an asset, such as a credit card debt.

Failing to keep track of their liabilities: It’s important to keep track of all of your liabilities, both secured and unsecured. This will help you stay organized and be aware of your financial obligations.

Ignoring their credit score: Your credit score is important because it is one factor that lenders will look at when considering a loan. A low credit score can lead to higher interest rates and may even prevent you from getting a loan altogether.

Not having a plan to pay off their liabilities: Once you have a good understanding of your liabilities, it’s important to create a plan to pay them off. This may include making extra payments on your debts or looking into consolidation or refinancing options.

Failing to stay disciplined: It’s important to stay disciplined when it comes to managing your liabilities. This means making your payments on time, keeping track of your debt, and not taking on new debt if you can’t afford it.